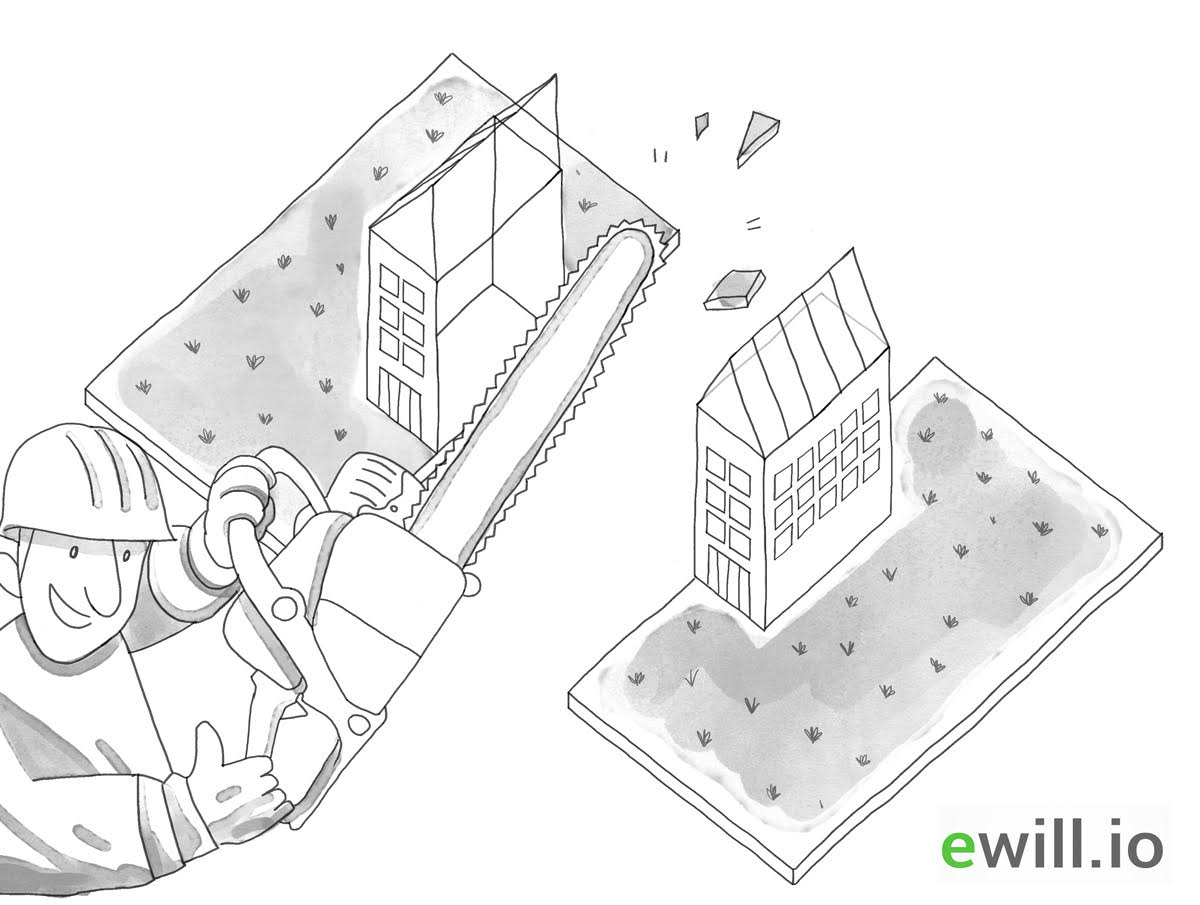

Sometimes it’s best to simply split your house in two.

Human relationships are complex. Sometimes things work well and sometimes they don’t. In the UK, 42% of marriages end in divorce.[i] An early death can strike at any time and destroy a happy relationship. Within a family, relationships can break down over money. We can’t change human nature or the randomness of life but we can make plans to avoid some of the potential fallout of a family breakup. One danger is “sideways disinheritance.”

Take the case of Joan and her children, Sarah and Mark. Joan was married to her husband Allan for 12 years, about the average for divorcing couples. The breakup was emotionally hard on everyone. As part of the settlement Joan received the family home and custody of the children. After the divorce Joan changed her will and left the house and the rest of her estate to Sarah and Mark.

A few years later Joan met Jack. He was also divorced and had two teenage daughters. They decided to get married and buy a larger house together so they could all live as one family. They wrote up new wills after the marriage. Like the vast majority of couples in the UK, they named each other as the primary beneficiaries since there is no inheritance tax between spouses. The four children were named as equal alternative beneficiaries and would each receive 25% of Joan and Jack’s combined estate once they both passed away, which seemed fair to everyone.

Unfortunately, three years later Joan was diagnosed with breast cancer and died shortly afterwards. All four children continued to live in the family house until they were old enough to make their way in life. Mark found a good job, got married and started a family. Sarah worked in the fashion business.

Jack lived for another 10 years. However, when Jack’s will went to probate Sarah and Mark discovered that he had made a new will after their mother died and left the family house to his children. Sarah and Mark got virtually nothing. That, my friends, is sideways disinheritance.

How could that happen? After Joan died Jack became the sole owner of the family house and all her assets. By law he could do whatever he wanted with those assets and make a new will which was different from Sarah’s original wishes. Jack could legally cut Sarah and Mark out of the will since they were adults and not financially dependent on him. Don’t get too judgemental about this. Anyone who has worked in estate planning has seen some pretty ruthless things happen when there is money and property on the table. Trust me.

The good news is that the worst elements of sideways disinheritance can be prevented if you plan ahead.

Some legal background first. Most couples in the UK buy their family home in one of two ways. They can be “joint tenants” or “tenants in common.” Joint tenants own their house together with commingled funds – think of a joint chequing account – no one keeps track of how it is split, they just know that they own it together. Should one partner die (even without a will), the other automatically assumes complete ownership of the property, as did Jack.

Alternatively, tenants in common each own a specific portion of a property. It could be divided any way, 50/50 or 25/75, whatever. What matters is that it’s a strict legal division of property. At the time of purchase the ownership percentage is registered on the title deed at the UK Land Registry. There are lots of reasons to buy as tenants in common. For example, three young people can pool their money for a deposit and buy a house together. Each would own a specific share.

An increasing number of couples in second marriages buy their home as tenants in common to simplify inheritance issues created by today’s complicated family structures. In terms of sideways disinheritance, buying as tenants in common enables you to protect your share of a property through the use of a trust.

Trusts get a rather bad press as they are considered by many as a way for the rich to dodge taxes using complicated loopholes. In reality, a trust is simply an agreement between two or more people for the care of asset. Trusts have been used in England since the time of the Crusades when knights left their lands “in trust” for a trustee to manage when they were off fighting in the Holy Land.

In our story, Joan could have bought the house with Jack as tenants in common on a 50/50 basis. Her will would have instructed that, if she died before Jack, her executors would create a Life Interest Trust to hold her 50% of the house and name Sarah and Mark as beneficiaries. The trust, rather than Jack, would legally own her share of the house and it would no longer be part of her estate. Jack could have a similar clause in his will should he die before Joan.

With a Life Interest Trust a surviving spouse has the right to live in the house until they die or remarry, after which the half of the house in the trust is passed on to the beneficiaries, in our story, Sarah and Mark. Problem solved and sideways disinheritance avoided.

Life is complicated but that doesn’t mean your will has to be, even if it involves splitting your house in two. Now you know.

This article has been sponsored by the good people at eWill.io (The world’s most sophisticated digital will).

[i] Divorce in England and Wales: 2016. Office of National Statistics Bulletin (October 2017).

*Note: We are not lawyers or a law firm and we do not provide legal, business or tax advice.